Cryptocurrency arbitrage offers a compelling opportunity for traders to capitalize on price discrepancies across different exchanges. However, this type of trading comes with its own set of challenges and risks, particularly when it comes to parallel arbitrage. In this post, we'll explore what crypto arbitrage is, delve into the specifics of parallel arbitrage, discuss potential risks, and highlight how using limit orders in a ctrading system can help mitigate these risks.

What is Crypto Arbitrage?

Crypto arbitrage involves buying a cryptocurrency on one exchange where the price is low and simultaneously selling it on another exchange where the price is higher. This exploits the price differences between the two markets to earn a profit on the spread between them. Because crypto markets are decentralized and vary in liquidity and trading volume, price discrepancies are common, making arbitrage a popular strategy.

Parallel Arbitrage Explained

Parallel arbitrage is a specific type of arbitrage where transactions are executed simultaneously on multiple exchanges. This method is crucial in the fast-moving crypto markets, where prices can change in milliseconds. By executing trades simultaneously, traders can capitalize on the arbitrage opportunity before the market adjusts to the price discrepancies.

Key Components of Successful Parallel Arbitrage:

Speed: One of the most critical factors in successful arbitrage is speed. Prices in the crypto markets can adjust quickly, and arbitrage opportunities can disappear in a moment. High-speed trading systems are essential to exploit these opportunities effectively.

Simultaneous Execution: To ensure that both the buy and sell orders are filled at the desired prices, it's vital to launch these trades simultaneously. This minimizes the risk of one side of the arbitrage failing to execute in time.

Potential Dangers in Crypto Arbitrage

While the rewards can be significant, crypto arbitrage is not without risks. One of the primary dangers is the failure to close one of the trades in a pair:

Incomplete Trades: If the crypto market moves rapidly or if there's low liquidity, you might end up with one side of your arbitrage trade executed (like buying the asset) but unable to sell it at a higher price on another exchange. This situation can lead to potential losses instead of profits.

The Importance of Speed

Speed is crucial in mitigating risks in parallel arbitrage. Using advanced trading algorithms and high-speed internet connections can significantly enhance the ability to execute trades simultaneously. Many traders use automated systems (often referred to as "bots") that can detect and execute arbitrage opportunities faster than any human could.

Using Limit Orders to Enhance Trading Safety

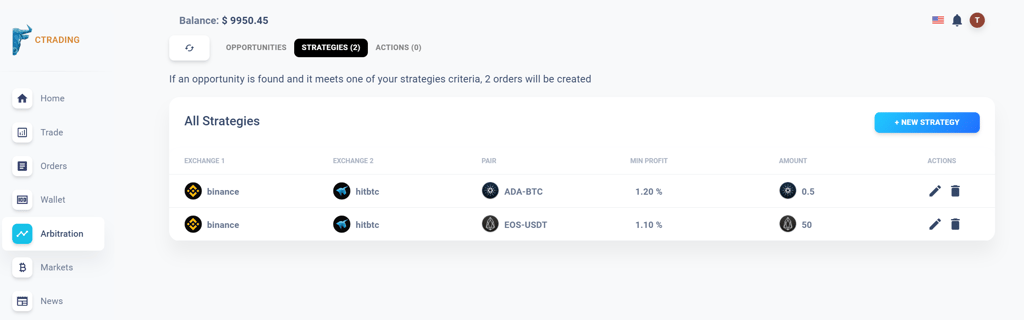

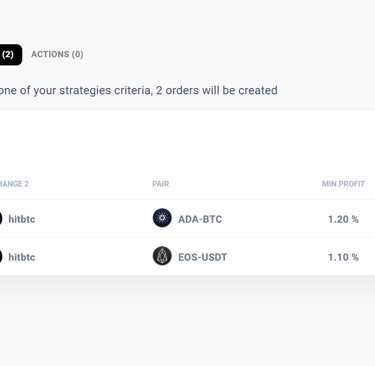

Our ctrading system is designed to maximize the chances of successful arbitrage by using limit orders. Here’s how it helps:

Price Control: Limit orders allow traders to set a maximum purchase price and a minimum sale price, ensuring that trades only execute within these parameters.

Slippage Prevention: By using limit orders, our system prevents slippage, which occurs when a trade is executed at a different price than expected due to changes in market prices.

Loss Minimization: In volatile markets, limit orders protect against significant losses by ensuring that trades are not executed if the price moves unfavorably.

Crypto arbitrage, especially parallel arbitrage, is a sophisticated trading strategy that offers significant profit potential but also comes with inherent risks. The key to successful arbitrage lies in executing trades rapidly and simultaneously across exchanges while using tools like limit orders to manage risks effectively. Our ctrading system is equipped to handle these demands, providing traders with the technology needed to navigate the complex world of crypto trading safely.

Understanding the mechanics and risks of arbitrage will not only help you capitalize on market inefficiencies but also protect your investments in the volatile world of cryptocurrency trading.